5 Prevalent Phishing Scams Wreaking Havoc in 2019

Does the thought of a text scam involving your business send chills down your spine?

Many cyber criminals use text messaging to target unsuspecting victims, and if you aren't up-to-date on the latest tactics used by text scammers, your business could be next. These kinds of fraudulent activities cost businesses thousands per year!

If you haven't heard, smishing (phishing scams via SMS) are relatively new security threats in which users are tricked into downloading a virus or providing sensitive information such as account access, social security numbers, and more.

We'll show you five of the most common phishing scams happening in 2019, so you know what to look for and what to do if your business is targeted.

5 Prevalent Phishing Scams Making the Rounds in 2019

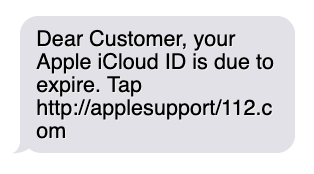

Has your business ever received a text message like this?

Unfortunately, responding or engaging with these types of messages can put your business at a serious security risk. The good news is that there are lots of telltale signs to help you spot phishing scams and measures you can take to protect yourself.

1. Bank of America Compromised Account

If your business banks with Bank of America, there's a phishing scam that you need to know about. In this scam, "fraudulent" activity is detected on users' accounts. To "remedy" the activity, users are asked to update personal information.

Some of these messages look authentic, but Bank of America warns consumers to remain skeptical of messages that claim to be from its customer service department. As a best practice, verify the source of the message. Additionally, check bank accounts on a regular basis. Be sure to write down all financial transactions and ensure transactions coincide with monthly statements.

2. Anonymous Billing Refund

If your business sells something online, you may be targeted by an overpayment scam. The scammer will contact you, make a generous offer, then make payment through a credit card or check. The total amount will exceed the agreed-upon price.

Then, the scammer will contact you with an "apology" for overpayment. The scammer will then ask you to refund the excess amount through an online banking transfer, pre-loaded card, or wire transfer. After sending the money, you realize the original credit card or check supplied was either stolen or fake.

As a best practice, do not send items to the buyer until their payment has been cleared by your bank. If you receive too much money, only agree to refund it back to the card that the buyer used originally.

3. Verizon Account Cancellation

Does your business use Verizon? You may be targeted by a phishing scam stating that your account has been suspended or deactivated. In most cases, users are asked to supply sensitive account information to reinstate the account.

Always verify the status of your account directly with Verizon. Additionally, you can always check the status and recent activity of your account by logging into My Verizon or through your My Verizon app. If the account is in good standing, the message you received is likely a case of phishing.

4. Western Union Payment

In this scenario, victims are contacted by individuals pretending to be a grandchild or relative in distress or a person of authority such as a medical professional, law enforcement officer, or attorney. The fraudster describes the situation as urgent (bail, medical expenses, emergency travel funds) and requires an immediate wire transfer. Unfortunately, no emergency has actually occurred, and unsuspecting victims are scammed out of thousands of dollars.

5. Local Job Notification

Unfortunately, scammers know that finding a job can be overwhelming. To trick prospects, scammers ask applicants to pay for placement. However, the promise of a job isn't the same thing as an actual job. If you're being asked to pay for a promise, it's likely a phishing scam. Here are some signs to watch for:

- You need to pay to get the job

- You need to supply your credit card or bank account information

- The advertisement is for an undisclosed job

Safeguard Your Business Against Phishing Scams

The bottom line is to stop before you engage with suspicious messages. A significant portion of the money lost due to phishing scams is attributed to personal data breaches, identity theft, and credit card fraud. Unfortunately, if the message seems to0 good to be true, it probably is. Avoid these cybercriminals at all cost!

The good news is that there are far more enterprises using business text messaging for good than those that use text messaging for bad. When used for good, the benefits of business text messaging are virtually boundless. Many of the world's leading businesses use text message marketing as a means to connect with customers. Additionally, smaller businesses can also take advantage of the immediacy and intimacy that only text message marketing delivers.

To get started, we recommend downloading our free guide. In this guide, we'll show you the nine steps all successful text marketers take to achieve texting stardom. Following these nine steps won't necessarily guarantee texting success, but it will definitely put you on the right path.

Get an unfair advantage by downloading our free guide today!

Photo: Unsplash/Clem Onojeghuo